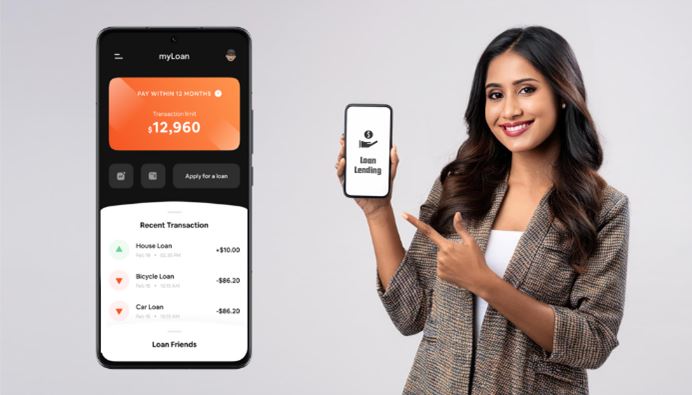

Why Hire Mobile App Developers for a Successful Loan Lending App

The digital transformation in the financial sector has revolutionized how we access and manage our finances. Among the most notable advancements is the development of loan lending apps, which provide a seamless, efficient, and user-friendly way for individuals and businesses to borrow money.

As the demand for these apps grows, so does the need for professional mobile app developers. In this blog, we will explore why hire mobile app developers to develop a loan lending app in the current era.

1. Expertise in Mobile App Development

Hiring mobile app developers with expertise in the field is the first step towards creating a successful loan lending app. These professionals possess the technical skills and knowledge required to build robust, secure, and scalable applications. They are well-versed in various programming languages, frameworks, and tools necessary for mobile app development. By leveraging their expertise, you can ensure that your app is built using best practices and adheres to industry standards.

Why Expertise Matters:

- Technical Proficiency: Mobile app developers are proficient in programming languages such as Swift, Kotlin, Java, and React Native, enabling them to create high-quality apps for both iOS and Android platforms.

- Frameworks and Tools: They have experience working with frameworks like Flutter, Xamarin, and Ionic, which facilitate cross-platform development and ensure a consistent user experience.

- Problem-Solving Skills: Developers can anticipate and address potential issues during the development process, ensuring a smoother and more efficient workflow.

2. Customization and Personalization

Every loan lending app is unique, catering to specific user needs and business goals. Hiring mobile app developers allows you to create a customized and personalized app that stands out in the competitive market. Developers can tailor the app’s features, design, and functionality to match your vision and requirements.

Customization Benefits:

- Unique Features: Developers can integrate unique features such as AI-driven loan approval processes, personalized loan offers, and real-time credit scoring to enhance the app’s value proposition.

- User Experience: Customization ensures that the app provides an intuitive and user-friendly experience, making it easier for users to navigate and access the services they need.

- Brand Identity: A personalized app reflects your brand’s identity and values, helping to build trust and loyalty among users.

3. Security and Compliance

Security is a paramount concern in developing a loan lending app. Users entrust these apps with sensitive financial information, and any breach can lead to severe consequences. Mobile app developers are well-versed in implementing security measures and ensuring compliance with relevant regulations.

Security Measures:

- Data Encryption: Developers implement robust encryption protocols to protect user data from unauthorized access.

- Secure Authentication: Features such as multi-factor authentication (MFA) and biometric verification add an extra layer of security to the app.

- Regulatory Compliance: Developers ensure that the app complies with industry regulations such as GDPR, CCPA, and PCI DSS, safeguarding user data and maintaining trust.

4. Integration with Financial Systems

A successful loan lending app requires seamless integration with various financial systems and third-party services. Developers have the expertise to integrate these systems, ensuring a cohesive and efficient user experience. For successful integration with the financial system, you need to consult with a top loan lending app development company.

Integration Capabilities:

- Banking APIs: Developers can integrate the app with banking APIs to facilitate direct transactions, account verification, and real-time updates.

- Credit Bureaus: Integration with credit bureaus allows the app to access users’ credit scores and histories, enabling accurate risk assessment and loan approval.

- Payment Gateways: Secure and reliable payment gateway integration ensures smooth and safe financial transactions within the app.

5. Scalability and Performance

As your loan lending app grows, it must handle an increasing number of users and transactions. Connecting to mobile app development services can be helpful in designing the apps with scalability and performance in mind, ensuring that your app can grow with your business.

Scalability and Performance Considerations:

- Cloud Services: Developers leverage cloud services like AWS, Azure, and Google Cloud to provide scalable infrastructure that can handle increased demand.

- Load Balancing: Implementing load balancing techniques ensures that the app remains responsive and efficient, even during peak usage periods.

- Performance Optimization: Developers optimize the app’s code and architecture to minimize latency and improve overall performance.

6. User-Centric Design

User experience is a critical factor in the success of any mobile app. Mobile app developers understand the importance of a user-centric design and focus on creating an intuitive and engaging interface.

User-Centric Design Elements:

- Intuitive Navigation: Developers design easy-to-navigate interfaces that allow users to access features and services with minimal effort.

- Visual Appeal: A visually appealing design enhances the user experience and encourages users to spend more time on the app.

- Feedback Mechanisms: Incorporating feedback mechanisms helps developers understand user preferences and make necessary improvements.

7. Faster Time-to-Market

In the fast-paced world of technology, getting your app to market quickly is crucial. Hiring experienced mobile app developers can significantly reduce the development time, allowing you to launch your app faster and gain a competitive edge.

Time-to-Market Advantages:

- Agile Development: Developers often use agile methodologies, which promote iterative development and continuous feedback, resulting in faster delivery.

- Prototyping: Rapid prototyping helps visualize the app’s features and functionality early in the development process, allowing for quicker adjustments and refinements.

- Testing and Debugging: Experienced developers conduct thorough testing and debugging to identify and resolve issues promptly, ensuring a smooth and timely launch.

8. Post-Launch Support and Maintenance

The launch of your loan lending app is just the beginning. Continuous support and maintenance are essential to keep the app running smoothly and to address any issues that may arise. Connecting with app maintenance services can be useful in addressing the post-launch errors.

Support and Maintenance Services:

- Regular Updates: Developers release regular updates to improve functionality, fix bugs, and enhance security.

- User Feedback: A dedicated support team can address user feedback and make necessary improvements to the app.

- Performance Monitoring: Continuous monitoring of the app’s performance helps identify and resolve potential issues before they impact users.

9. Cost-Effective Solutions

While hiring mobile app developers involves an initial investment, it can be a cost-effective solution in the long run. Professional developers can help you avoid common pitfalls and ensure that your app is built efficiently and effectively.

Cost-Effective Benefits:

- Reduced Development Time: Experienced developers can complete the project faster, reducing overall development costs.

- Quality Assurance: High-quality code and thorough testing reduce the likelihood of costly post-launch issues.

- Scalable Solutions: Developers design scalable solutions that can grow with your business, minimizing the need for expensive overhauls.

10. Competitive Advantage

In the competitive world of financial technology, having a high-quality loan lending app can provide a significant advantage. Hiring mobile app developers ensures that your app stands out in the market and meets the needs of your target audience.

Competitive Advantages:

- Innovative Features: Developers can incorporate innovative features that differentiate your app from competitors.

- User Trust: A well-designed, secure app builds trust among users, encouraging them to choose your service over others.

- Market Positioning: A successful app enhances your brand’s reputation and positions you as a leader in the loan lending industry.

Conclusion

In conclusion, hiring mobile app developers is crucial for the successful development of a loan lending app. Their expertise, customization capabilities, focus on security and compliance, integration skills, scalability, user-centric design, faster time-to-market, post-launch support, cost-effective solutions, and competitive advantage all contribute to the creation of a high-quality, successful app. By investing in professional mobile app developers, you can ensure that your loan lending app meets the needs of your users and stands out in the competitive market.

If you’re ready to take the next step in app development, consider hiring mobile app developers from a reputable company like Nimble AppGenie. Our team of skilled developers has the expertise and experience to bring your vision to life and create a successful loan-lending app that meets your business goals. Contact us today to get started on your journey towards a successful loan lending app.