Back-Office Capabilities of core banking software: key requirements and features

The Core Banking system, serving as the back-office engine, plays a pivotal role in processing daily banking and e-wallet transactions, managing customer accounts, and ensuring robust financial accounting. This article delves into each module of Advapay’s Core Banking platform, outlining their functional capabilities tailored to support the primary operations of digital banks, e-wallets, and payment institutions.

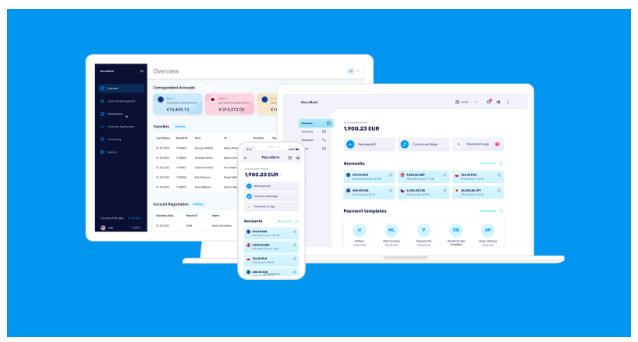

Macrobank, the back-office solution by Advapay, boasts an extensive range of functionalities designed to meet sophisticated regulatory, business, and customer requirements. These capabilities are crafted to not only ensure compliance with regulatory standards but also to maximize operational efficiency, reduce costs, and deliver an unparalleled customer experience.

Key Requirements for the Core Banking System’s Back-Office:

Regulatory Compliance:

Digital banks and payment institutions must navigate the evolving regulatory landscape. The adaptable architecture of the Core Banking system addresses this challenge, ensuring compliance with European regulations like the PSD2 directive, Open Banking, and meeting local financial regulator legislation. This includes the seamless submission of various reports mandated by regulatory authorities.

Automation of Processes:

Automated processes enhance productivity, customer service, and operational performance while reducing costs. The Core Banking system provides functionality for creating diverse customer groups and implementing rules for Anti-Money Laundering (AML), payments, or customer-related processes. This automation can be tailored to meet specific business needs.

Customer-Centric Approach:

Exceptional customer experiences are paramount in the banking and fintech sectors. The flexibility and capabilities of the Core Banking system play a crucial role in shaping these experiences. From streamlining the onboarding process to automating payments, the system ensures a customer-centric approach, addressing their financial challenges effectively.

Core Banking System Back-Office: Comprehensive Capabilities

Delving into the functionalities of our Core Banking software solution, we present key modules and their capabilities, each tailored to support the primary operations of digital banks, e-wallets, and payment institutions.

Current Accounts & IBANs:

Automate current account creation and generate diverse IBANs—multicurrency, single-currency, or sets of currencies. Customers can apply for individual or business accounts, choosing from over 30 currencies. Full or partial automation, along with customizable rules, ensures operational flexibility.

Financial Accounting & General Ledger:

Ensure real-time, multi-currency accounting compliant with International Financial Reporting Standards (IFRS). The module includes General Ledger and customizable Chart of Accounts. It empowers businesses with detailed reports, facilitating regulatory compliance and aiding in long-term planning.

Payments and Transfer Processing:

Initiate various international, local, or internal payments and transfers. The module integrates with correspondent accounts and currency exchange platforms, offering flexibility in payment options. Automated tariff and commission settings enhance the efficiency of payment processes.

Currencies and Rates:

Facilitate automated currency conversion through API and integrations with liquidity providers. The module allows businesses to choose preferred currency exchange providers, offering flexibility in setting rates and tariffs based on different parameters.

Client Onboarding and Management:

Streamline customer applications, profile creation, access granting, and document management. The module supports individual and business profiles, with customizable onboarding workflows, providing a customer-friendly experience.

AML/KYC:

Enable remote identity verification, AML/KYC document checks, and transaction screening. The module allows manual or automated verification through integrations with KYC/AML providers, along with customizable transaction filters and limits.

Tariffs and Fees:

Set up diverse tariff categories and apply specific fees based on parameters such as payment types, countries, and customer types. The module supports various payment strategies, offering unlimited options for fee creation in percentage, fixed values, or both.

In conclusion, the Back-office Core Banking system stands as the linchpin of comprehensive and efficient financial operations for digital banks, e-wallets, and payment institutions. Through its diverse modules and capabilities, it addresses critical facets of modern banking, from automated current account creation and financial accounting to seamless payments processing and client onboarding. The system’s adherence to regulatory requirements, coupled with its modular flexibility, not only ensures compliance but also allows for tailored solutions that align with the unique needs of businesses. Moreover, the integration of AML/KYC measures fortifies security, while the dynamic tariff and fee module caters to diverse business models. As a centralized hub for managing transactions, accounts, and customer interactions, the Back-office Core Banking system emerges as a powerful tool, offering scalability, automation, and a robust foundation for the evolving landscape of financial services.