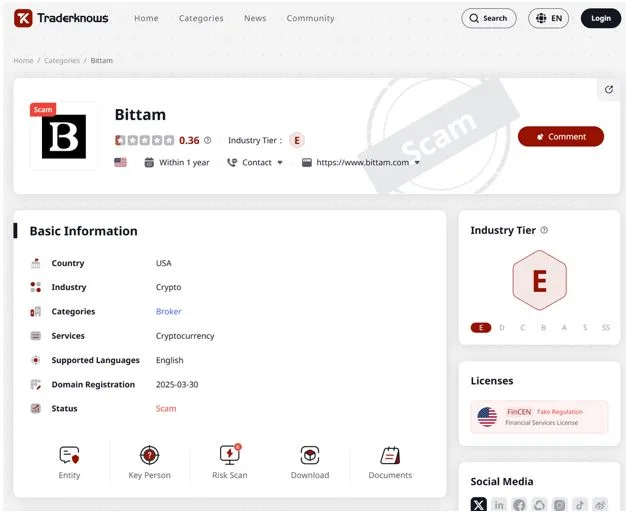

Bittam Scam Question: Why This Crypto Platform Raises Trust Issues?

Anyone encountering Bittam for the first time may notice that the platform appears visually complete and confidently branded. The messaging focuses on freedom, accessibility, and seamless crypto trading across devices. On the surface, this aligns with what many modern crypto platforms promise. The real question, however, is not how Bittam presents itself, but what happens when those claims are examined under practical scrutiny.

What Does a New User Actually Learn Before Depositing

A critical test for any crypto platform is how much meaningful information a user can access before committing funds. In Bittam’s case, the onboarding experience is smooth, but the informational depth is shallow. Key elements such as detailed fee logic, execution rules, liquidity handling, and withdrawal constraints are either briefly mentioned or not explained at all.

This absence matters. In legitimate trading environments, these details are not optional extras; they are core components of informed consent. When a platform minimizes pre-deposit disclosure, it retains disproportionate control over how user balances are later interpreted and handled.

The Problem With Compliance Messaging That Sounds Bigger Than It Is

Bittam highlights MSB registration as a trust signal. To an average user, this may appear to imply regulatory supervision. In practice, MSB status does not regulate crypto exchanges, custody, or trading integrity. It is a reporting framework, not an investor protection mechanism.

According to research cited by TraderKnows, the misuse of MSB terminology is one of the most common ways high-risk platforms manufacture perceived legitimacy without submitting to meaningful oversight. This creates a dangerous gap between what users think they are protected by and what actually exists.

Why Technical Claims Without Proof Create More Risk Than Comfort

Security language plays a major role in Bittam’s positioning. Cold storage, multisignature protection, and system stability are all mentioned. What is missing is independent confirmation. There are no published audits, no named custody partners, and no externally verifiable security attestations.

In crypto, security claims without evidence are not neutral; they shift risk entirely onto the user. If something goes wrong, there is no framework for accountability or verification.

A Platform That Exists Online But Barely Exists Publicly

Another way to evaluate trust is to observe how a platform exists beyond its own website. Bittam’s public footprint is minimal. Social channels show little to no organic activity, and user-driven discussions are scarce.

This is not about popularity. It is about visibility. Platforms that serve real users inevitably generate feedback, questions, criticism, and third-party references. When those signals are missing, it becomes harder to distinguish between early-stage growth and structural inactivity.

What Happens When Education Is Absent

One of the quiet indicators of platform intent is whether users are educated or simply onboarded. Bittam provides no structured learning resources, no risk explanations, and no guidance for inexperienced traders.

This matters because uninformed users are more likely to misunderstand leverage, liquidity, and withdrawal mechanics. Platforms that rely on that confusion tend to see higher dispute rates later on.

Why the Scam Question Keeps Appearing

The question of whether Bittam is a scam does not arise from a single red flag. It emerges from accumulation. Short operational history, overstated compliance language, limited transparency, weak public presence, and missing education all contribute to a pattern.

None of these alone proves malicious intent. Together, they create an environment where trust must be assumed rather than demonstrated.

How Users Should Interpret the Risk

For crypto users, the safest approach is not to label platforms prematurely, but to recognize when risk concentration becomes excessive. Bittam currently places a heavy burden on users to trust claims that are difficult to verify independently.

That imbalance is precisely why the scam discussion persists.

Final Thought

In crypto markets, legitimacy is built through disclosure, verification, and accountability over time. Until those elements are clearly observable, platforms like Bittam should be approached with caution, not optimism.