Discover the Gilded Opportunities By Investing in Gold and Silver in 2024

Introduction:

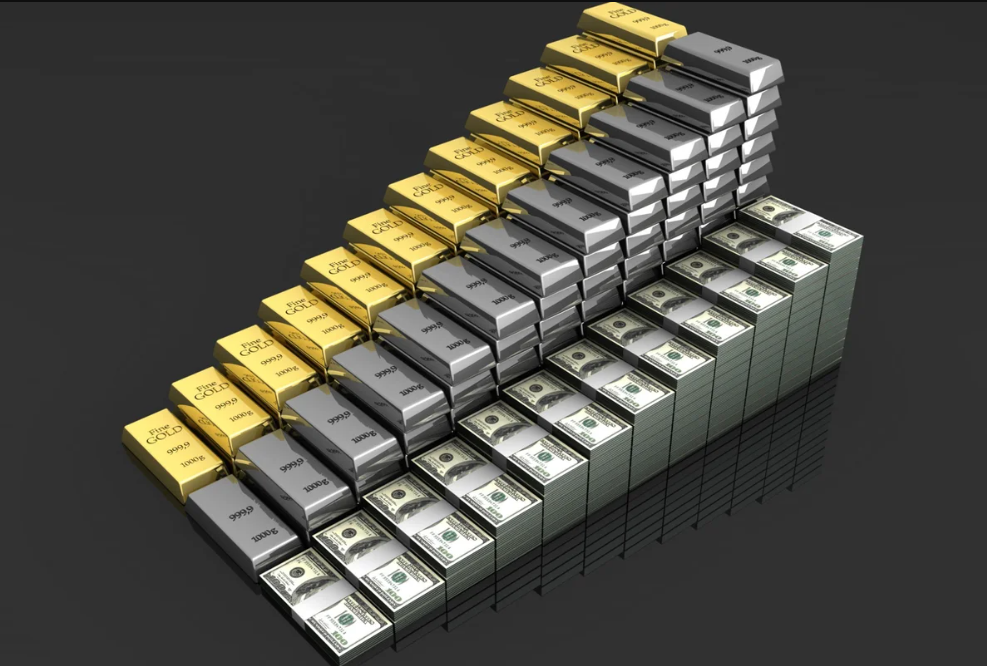

As we step into 2024, the spotlight on buying gold, buying silver bars, and buying gold bars is brighter than ever. Gold and silver, revered for their intrinsic value and historical significance, continue to captivate the attention of investors seeking stability and hedging against economic uncertainties. This article explores the multifaceted importance of investing in these precious metals in the current financial climate, shedding light on their historical resilience, tangible appeal, and their role as a prudent safeguard against the unpredictable fluctuations of modern markets.

Weathering the Storms of Time:

Gold and silver have long been recognized as enduring stores of value, with a track record that spans centuries. While currencies rise and fall, empires crumble, and financial systems undergo seismic shifts, these precious metals have maintained their allure. The timeless resilience of gold and silver can be traced back to their scarcity and the inherent trust humanity places in them as symbols of wealth.

In times of economic turmoil, investors often flock to the safety of gold and silver. These precious metals act as safe-haven assets, providing a buffer against inflation, currency devaluation, and geopolitical uncertainties. The historical data speaks for itself, with gold and silver consistently proving their mettle during periods of crisis.

The Physicality of Gold and Silver Investments:

Unlike stocks, bonds, or digital assets, gold and silver offer investors the tangible pleasure of holding their wealth in physical form. Whether it’s a gleaming gold bar or a stack of silver coins, the sensory experience of owning precious metals adds an element of satisfaction and security to one’s investment portfolio.

The tangibility of gold and silver investments provides a unique opportunity for diversification. Investors can physically possess their assets, reducing their exposure to the digital vulnerabilities that accompany many contemporary investment options.

Prudent Safeguard Against Economic Fluctuations:

One of the most compelling reasons to invest in gold and silver is their proven ability to hedge against inflation. As central banks continue to pump money into economies, the risk of currency devaluation looms large. Precious metals, with their limited supply, act as a safeguard, preserving wealth even as the value of fiat currencies erodes.

The volatility of financial markets is a constant reality. Gold and silver, with their low correlation to traditional assets like stocks and bonds, offer a protective shield against market fluctuations. As the global economic landscape becomes increasingly unpredictable, the stability provided by precious metals becomes invaluable to investors seeking a reliable anchor for their portfolios.

Buying Gold and Silver Bars: Practical Considerations:

In 2024, buying gold, buying silver bars, and buying gold bars will become more accessible than ever. Online platforms, specialized dealers, and even local banks provide avenues for investors to acquire these precious metals with ease. The convenience of digital transactions, coupled with secure delivery mechanisms, has eliminated many of the barriers that once existed for potential investors.

Once acquired, the question of storage and security arises. Investors can choose between storing their precious metals in secure vaults provided by dealers or opting for precious metal vault storage. The decision often hinges on individual preferences, risk tolerance, and the scale of the investment. The emphasis on secure storage underscores the physical nature of these investments.

Market Trends and Future Prospects:

As we navigate the digital age, gold and silver are not immune to technological advancements. The rise of blockchain technology has given birth to digital gold, allowing investors to own fractions of gold securely recorded on a blockchain. This fusion of tradition and innovation opens up new possibilities for both seasoned investors and those looking to dip their toes into the precious metals market.

The extraction and refining processes associated with gold and silver mining have long been scrutinized for their environmental impact. In 2024, the focus on sustainable and ethical practices in mining will gain prominence. Investors are increasingly considering the environmental footprint of their investments, leading to a shift towards responsibly sourced and eco-friendly precious metals.

Conclusion

In conclusion, the importance of investing in gold and silver in 2024 cannot be overstated. These timeless metals offer a sanctuary of stability in a world marked by economic uncertainties and market volatility. Whether it’s the historical resilience, tangible appeal, or the practical considerations of buying gold, buying silver bars, and buying gold bars, the allure of these precious metals continues to shine brightly. As we embrace the opportunities and challenges of the future, the enduring value of gold and silver remains a beacon for investors seeking to safeguard their wealth and navigate the shifting tides of the global economy.