Finding the Best Way to Send Money Internationally

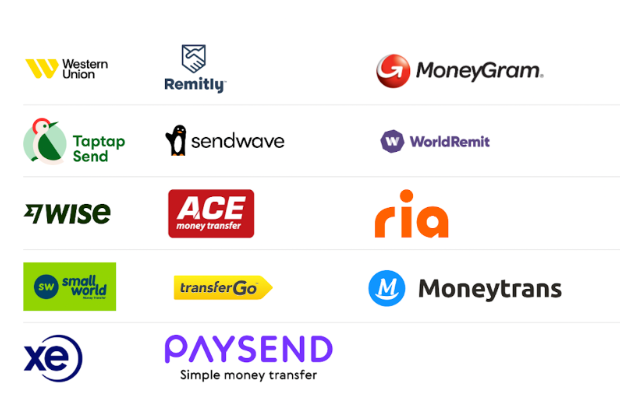

Sending money across borders has become a common necessity, whether for personal reasons like supporting family members or for business transactions. You can send moeny with several money transfer applications with Western Union, Ria, , Ace, Xe, Remilty, Wise, Taptapsend, Worldremit ….) .However, the cost of international money transfers can vary significantly depending on the provider, exchange rates, and transfer methods used. Fortunately, with a bit of research and careful consideration, it’s possible to find the cheapest way to send money internationally.

Comparison Shopping: Understanding the Costs

Before delving into the various methods of sending money internationally, it’s essential to understand the factors that contribute to the overall cost. These typically include:

- **Transfer Fees**: Many money transfer services charge a flat fee or a percentage of the transfer amount. These fees can vary widely, so it’s crucial to compare them across different providers.

- **Exchange Rates**: Exchange rates determine how much of one currency you’ll receive in exchange for another. compare providers fx rate USD to INR, or CAD, GBP, EUR to MAD, BDT, LKR, PKR, COP,EGP, MXN .

- **Transfer Speed**: The speed of the transfer can also impact its cost. Generally, faster transfers tend to be more expensive, while slower options may offer better rates.

- **Payment Method**: Some providers offer lower fees or better exchange rates for certain payment methods, such as bank transfers or debit cards, compared to credit cards.

- **Recipient Options**: Consider whether the recipient needs to receive the funds in cash, to a bank account, or via a mobile wallet, as this can affect both the cost and the available transfer methods.

Exploring Transfer Options

Once you’ve grasped the cost factors, it’s time to explore the various methods of sending money internationally:

- **Bank Transfers**: Traditional banks offer international wire transfers, but they often come with high fees and unfavorable exchange rates. However, if you’re sending large amounts or need a secure option, this might still be worth considering.

- **Money Transfer Operators (MTOs)**: MTOs like Western Union, MoneyGram, and Ria specialize in international money transfers. While they’re convenient and offer various transfer options, they tend to have higher fees and less competitive exchange rates compared to other options.

- **Online Transfer Services**: Online platforms such as TransferWise (now Wise), Remitly, and Xoom have gained popularity for their low fees and competitive exchange rates. They often offer transparent pricing and allow you to send money directly to the recipient’s bank account or mobile wallet.

- **Cryptocurrency Transfers**: Cryptocurrencies like Bitcoin and Ethereum offer an alternative way to send money internationally. While they can be fast and relatively inexpensive, they come with volatility risks and may not be suitable for everyone.

- **Peer-to-Peer (P2P) Services**: P2P services like PayPal, Venmo, and Cash App allow you to send money internationally, although their fees and exchange rates may not always be the most competitive.

Choosing the Cheapest Option

To find the best way to send money internationally, consider the following tips:

- **Compare Fees and Exchange Rates**: Use online comparison tools or visit the websites of different providers to compare their fees and exchange rates for your specific transfer amount and destination.

- **Consider Transfer Speed**: If time is not a constraint, opt for slower transfer options, which tend to be more cost-effective.

- **Evaluate Payment Methods**: Some providers offer lower fees for certain payment methods, so choose the one that suits your preferences and budget.

- **Look for Promotions and Discounts**: Keep an eye out for promotional offers, referral bonuses, or discounts that could further reduce the cost of your transfer.

- **Read Reviews and Ratings**: Before committing to a provider, read reviews and ratings from other users to ensure reliability and customer satisfaction.

- **Factor in Exchange Rate Guarantees**: Some providers offer exchange rate guarantees for a specific period, protecting you from sudden fluctuations in currency values.

while sending money internationally can seem daunting, finding the cheapest option is achievable with careful research and consideration. Ideal Remit plaform help you to best money transfer services By comparing fees, exchange rates, transfer speeds, and payment methods across various providers, you can ensure that your hard-earned money reaches its destination efficiently and affordably.