How FHA Loans Are Bridging the Gap for California’s Low-Income Buyers

Homeownership has become a pricey dream in the expensive California real estate market. Thus, it seems complicated for a low-income buyer to get one. Critical sources of access to homeownership come with FHA loans California, which allow easy down payments and flexible credit requirements to ease the barrier to buying a home. Read on further to understand how FHA loans are being used in California to address affordability, what

programs exist to assist buyers, and how the FHA loan bridges that gap for those who need it most.

Understand an FHA loan and Some of its Key Features

An FHA loan is an insured mortgage under the Federal Housing Administration. With the intent to assist low-income or low-credit buyers, this type of loan had streamlined features to facilitate homeownership for those not qualifying under conventional mortgages.

- Low Down Payment Requirement: A 580 credit score or better allows a purchaser to obtain an FHA loan with only 3.5% of the down payment money. A 500-579 credit score allows FHA loans with only 10% down. This makes it easier for purchasers who may not have had much extra money in the first place to use more significant down payment funds for their conventional loan.

- Flexible Credit Requirements: The FHA adjusts for buyers with lower credit, allowing clients with scores of 500 to qualify. Such flexibility is beneficial for first-time homebuyers or those with limited credit experience.

- Higher Debt-to-Income (DTI) Ratios: FHA loans can tolerate a higher DTI ratio, which can be very helpful for buyers who carry other financial burdens, such as student loans or car payments. That extra leeway to qualify for a more significant DTI ratio is essential for those residing in expensive states like California.

These factors make FHA loans a viable option for those who otherwise would be denied conventional financing.

How FHA Loans Are Bridging the Gap for California’s Low-Income Buyers

The Role of FHA Loans in California’s High-Cost Housing Market

California is famous for its competitive housing market, where median home prices are quite higher than the national average. Saving enough to enter this market can be a tough challenge for low-income buyers. FHA loans Califonia help bridge these gaps by setting flexible loan limits that match local property values.

For example, the FHA loan limits in cheaper regions are set at an average of $498,257, while in high price-counties like Los Angeles and San Francisco, that figure can go as high as $1,149,825. This allows the FHA loan to come into play in different market segments because it accommodates the buyer’s value reality while considering the kind of house they can afford in a particular region.

State Program Initiatives to Increase Ease of Access to FHA Loan

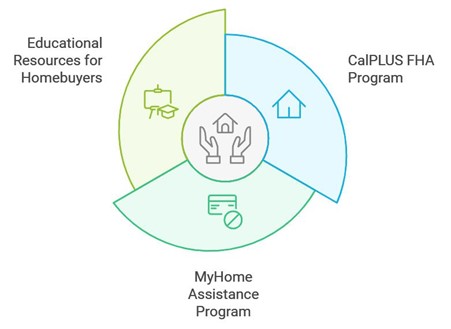

California offers several other assistance programs that back up the FHA loans and help homebuyers keep the costs associated with a new home under control. These kinds of programs are usually through CalHFA and generally reduce the burden of that initial financial hole for a homebuyer:

- CalPLUS FHA Program: The CalPLUS FHA program involves an FHA-insured mortgage with down payment assistance that bridges upfront costs such as down payments and closing. It is an added boost towards bridging affordability gaps and giving the lower-income buyer adequate finances to handle the initial expenses without overstretching the income pocket.

- MyHome Assistance Program: CalHFA provides a deferred-payment junior loan to the tune of up to 3.5% of the purchase price or appraised value, which can form part of the down payment or closing costs to help the purchaser stabilize his finances

once he buys a home with the deferred payment feature.

- Educational Resources for Homebuyers: Many assistance programs require homebuyer education courses for buyers, making them learn the responsibilities of homeownership. The homebuyer education course equips the buyer with adequate preparation in managing California FHA mortgage payments and extra costs that accrue while owning a house, putting them on the right path for the long term.

As such, FHA loans California will be accessible to more buyers because they can help bridge financial gaps in the high-cost market.

Challenges and Considerations for FHA Loan Borrowers

While FHA loans offer a lot of advantages, low-income buyers must also be cognizant of a couple of associated considerations:

- Mortgage Insurance Premiums (MIP): With FHA loans, there are both an upfront and ongoing mortgage insurance premium. Unlike private mortgage insurance (PMI) for conventional loans, FHA’s MIP typically lasts for the life of the loan. This added cost impacts monthly payments and should be considered in budget planning for those on tight budgets.

- Primary Residence Requirement: The FHA loan is to acquire a primary residence. In other words, a buyer can’t use the loan to buy investment properties. This restriction can disadvantage those interested in generating rental income in multifamily properties.

- Market Competition: In California, a highly competitive real estate market, the FHA purchaser may be unfavorable when competing against all-cash buyers or conventional financing purchasers, typically having fewer conditions and sometimes closing the transaction more expeditiously. Therefore, a potential delay and additional terms could mean a disadvantage.

For some homeowners, the ability to refinance FHA loans in the future can provide relief, allowing them to lower monthly payments or shift to a conventional loan to avoid lifetime MIP costs. These are some of the factors that FHA borrowers have to consider so that they can maximize the benefits to be derived from the program and minimize challenges that will likely arise during the buying process.

How Munshi.Biz Helps FHA Home Loan Applicants?

The home-buying process is a very stressful one, especially for first-timers. Munshi.Biz assists the process by providing individualized consultations that help buyers utilize their FHA loans for the most significant benefit.

- Customized Solutions:Biz customizes advice based on a specific client’s unique financial condition and provides complete comprehension of all the steps in an FHA application process. From applying for an FHA construction loan to exploring options for FHA refinance, Munshi.Biz clarifies every step for a hassle-free process.

- Complete Guidance for First-Time Buyers: Buying a home is the most significant financial decision. At Munshi.Biz, we will become the home-buying resource to assist our clients in making informed decisions. Through FHA loans and assistance programs at the state levels, we give our clients the confidence and support they need for homeownership.

Through Munshi.Biz, homebuyers get professional experts who are well conversant with the specific market conditions of California, thereby making FHA loan application processes much more streamlined and transparent.

Final Thoughts

FHA loans bridge the gap for low-income homebuyers in California’s high-cost housing market. Other programs that CalHFA provides would be applied to reducing the financial barriers that otherwise prevent homeownership, considering the availability of options such as lower down payments, flexible credit requirements, and state-level assistance programs. At Munshi.Biz, the difference is made in clients’ lives through FHA loans by guiding them through the process of making appropriate decisions for their financial well-being and finding solutions in financing.