How to craft effective Chat GPT prompts for accounting firms

Chat GPT use has exploded since its release in 2022. In the short time it’s been on the market, Chat GPT has become an indispensable tool for professionals in all sorts of industries, from technology to education.

However, the quality of the responses you get from Chat GPT depends on the prompts you send. Well-crafted prompts increase the clarity, depth, and overall accuracy of Chat GPT’s responses. When it comes to using Chat GPT for accounting firms, this can provide many advantages.

Understanding the role of Chat GPT in tax preparation

Chat GPT is a support and informational tool. It can assist, but it’s important to know that Chat GPT cannot replace experienced and professional tax advice or the need for tax preparation to be done by a qualified professional.

That being said, Chat GPT can serve the tax preparation process in several ways, including:

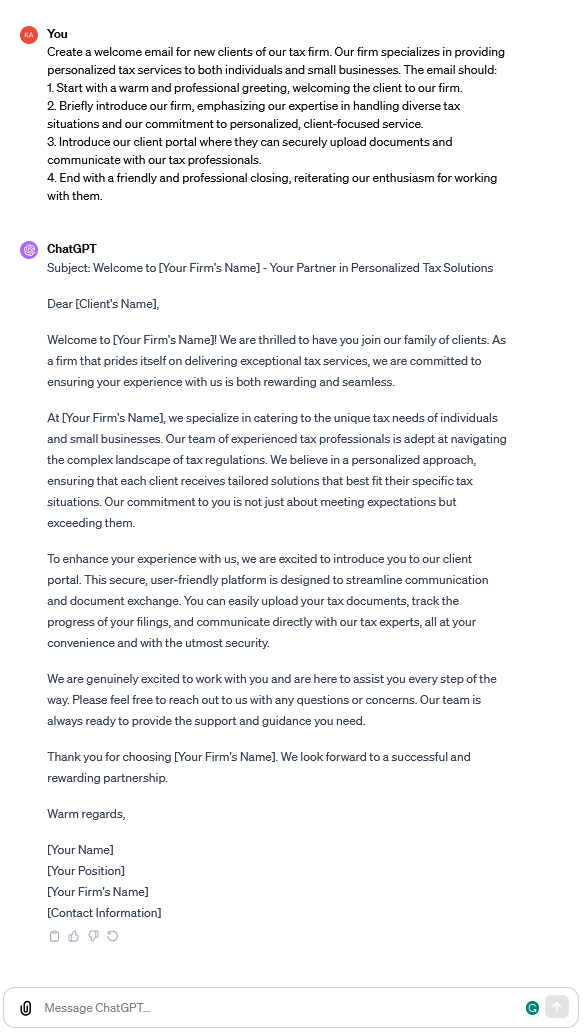

- Communication generation: tax firms can use Chat GPT to generate welcome emails, follow-up messages, or various other notes that need to be sent to clients regularly.

- Information inspiration resource: ChatGPT can provide quick access to a wide range of information, including insights, interpretations, and updates on current tax laws. However, this should be used as a source of inspiration for further research, as Chat GPT is only semi-regularly updated.

- Tax planning suggestions: ChatGPT can assist in generating tax planning strategies by exploring various tax-saving opportunities and scenarios tailored to different client profiles.

- Scenario analysis: tax firms can use Chat GPT to compare and contrast different tax situations to aid decision-making. For example, it can analyze the tax implications of different business decisions, investment options, or personal finance choices, helping clients understand the potential tax outcomes of each scenario.

- Calculation assistance: while not a replacement for specialized tax software, ChatGPT can assist with basic tax calculations. It can provide estimates and rough calculations for things like estimated tax payments, deductible expenses, or taxable income, offering a quick reference point for more detailed calculations.

Identifying tax professionals’ needs

To utilize Chat GPT in tax preparation effectively, it’s crucial to fully understand your needs before creating a prompt. These needs may include staying updated with the latest tax laws, simplifying complex tax calculations, or managing client queries. Recognizing these needs will help make the prompts more relevant and useful.

Create a list of everything you need before prompting Chat GPT. Instead of telling it to create a welcome email, inform it about who you are, how you would like the email to sound, and the points you need to be addressed.

5 tips for crafting effective Chat GPT prompts

Creating Chat GPT prompts to get the responses you desire is a little art and a little science. To get you started down the right path, follow these five tips.

1. Be specific and clear

When formulating prompts, clarity and specificity are key. This not only helps in obtaining precise answers but also reduces the time spent on follow-up prompts. It’s particularly beneficial when dealing with complex tax codes and regulations that vary widely based on jurisdiction, type of tax, and specific financial circumstances.

To that end, clarity in language and terms used is also vital. For example, instead of asking, “How do I calculate a W-2 tax return?” a more effective prompt would be, “What are the steps to calculate a federal and state individual W-2 tax return in [specific state] for the fiscal year 2023-2024?” Tax terminology is intricate, and using the correct terms in the right context ensures that the AI understands what you need.

2. Incorporate context

Providing context helps Chat GPT understand your prompt better. Including specific details about the scenario you’re addressing guides Chat GPT in generating more targeted and applicable advice information.

For example, a prompt like “Explain the tax implications for a small business” becomes significantly more useful when context is added: “Explain the tax implications for a sole proprietorship in California considering the latest 2024 tax reform.” Including the additional context of business structure, location, and time helps Chat GPT tailor its response to be more relevant and helpful.

In addition to these specifics, context can include other factors, such as the type of client (individual, business, non-profit), size of the business, industry specifics, or anything else that may affect the context of your prompt.

3. Focus on current regulations

Tax laws change frequently. Make sure your prompts are up to date by referencing current legislation or asking for the latest information available as of a specific date.

The information Chat GPT has access to is usually delayed, so be sure to cross-reference the information it’s working off of with the most current regulations to be sure its knowledge is up to date.

In this regard, it’s beneficial to reference specific legislative acts, recent tax law amendments, or current IRS guidelines in the prompts. This approach helps in obtaining information that reflects the latest legal standards and tax norms. For example, a prompt like, “Explain the deductions available for a married couple filing jointly under the [specific country’s] Tax Cuts and Jobs Act of [year],” directly ties your prompt to a particular piece of legislation.

4. Utilize examples

Incorporating examples in your prompts can guide the AI to provide more targeted information. This is particularly useful in tax preparation, where theoretical knowledge needs to be applied to specific cases.

For example, a prompt like “How does a capital gains tax increase affect taxpayers?” becomes much more tangible and informative when phrased as, “How would a capital gains tax increase from 15% to 20% impact an individual with an annual income of $100,000?” By including specific figures and scenarios, Chat GPT can provide a detailed and practical example that mirrors real client situations.

5. Ask for summaries or explanations

Tax professionals often need to digest large amounts of complex information. This is where Chat GPT can be particularly useful by providing summaries or simplified explanations if you just need an overview of something complex.

If the information you need a summary of is available to Chat GPT, then you can name it and ask for a summary. Otherwise, you can upload a document or copy and paste text to Chat GPT and ask for a summary.

Best practices for using Chat GPT in tax preparation

Getting the most out of Chat GPT isn’t just about knowing its functions and how to prompt it. Adhering to a set of best practices aids in delivering the most significant possible benefit to your tax firm.

- Continue learning: keep updating your knowledge about AI capabilities and limitations in the context of tax-related applications by reading articles and doing other research.

- Respect data privacy: exercise caution regarding client confidentiality and data security when using Chat GPT. Avoid sharing sensitive personal or financial client information in your prompts.

- Verify: always cross-verify the information provided by Chat GPT with official and authoritative sources. While Chat GPT can provide quick and useful insights, tax laws and regulations require precise and up-to-date information. Consult current legal texts, official government websites, or trusted tax research databases for confirmation.

- Give feedback: your initial interactions with Chat GPT will be like a conversation as you begin to understand how to refine your prompts to get the responses you want. Have that conversation and give feedback on the responses you’re getting to better understand how to get the responses you want with the first prompt.

Conclusion

Chat GPT is a powerful tool for tax firms seeking to enhance their efficiency and accuracy. By crafting effective prompts tailored to specific needs and adhering to best practices, you can leverage AI to gain insights and stay ahead in your field. Remember, the key to creating successful prompts lies in being clear, context-aware, and up to date with the latest tax regulations and technologies.