The Ultimate Verification: Exploring the Best of HyperBit Legit

Introduction

The blockchain industry has seen its fair share of groundbreaking innovations and elaborate scams over the past decade. Amid this rapidly evolving landscape, one company that has captured significant attention, both positive and negative, is HyperBit Legit. While the company has been heralded by many as a pioneering force in the world of blockchain technology, it has also been the subject of increasing scrutiny and allegations of fraudulent activities.

The Rise of HyperBit Legit: Innovative or Illusory

They asserted that this hybrid proof-of-work and proof-of-stake protocol would solve the scalability, security, and interoperability issues that plagued earlier blockchain platforms.

Backed by a team of highly credentialed developers and advisors, HyperBit quickly gained traction, attracting significant investment and partnerships with several prominent companies and organizations. The launch of the HyperBit Token (HBT) in 2021 further fueled the company’s growth as investors and speculators flocked to the promising new cryptocurrency.

However, as HyperBit’s profile and valuation continued to rise, so did the scepticism and allegations surrounding the company’s legitimacy. Critics began to scrutinize the claims made by Wilkinson, Pereira, and their team, calling into question the technical prowess of the HyperChain consensus mechanism and the substance behind the company’s high-profile partnerships and client engagements.

The Unraveling of HyperBit’s Credibility

The first major red flag emerged when independent blockchain experts and researchers began to poke holes in HyperBit’s technical whitepaper and the purported capabilities of the HyperChain protocol. Several prominent figures in the industry pointed out inconsistencies, logical flaws, and a lack of substantive evidence to support the company’s grandiose claims about scalability, security, and interoperability.

“When you dig into the technical details of HyperChain, it becomes clear that it’s not the revolutionary breakthrough that HyperBit claims it to be,” says Dr Liam Chen, a respected blockchain researcher and professor. “Many of the purported innovations simply don’t hold up under scrutiny, and the overall architecture seems to be more smoke and mirrors than genuine innovation.”

Further investigations uncovered troubling discrepancies in HyperBit’s public statements and marketing materials. For example, the company’s impressive list of partners and clients appeared to be largely overstated or even fabricated, with several organizations needing more meaningful involvement with HyperBit.

“We were approached by HyperBit a few years ago, but after reviewing their technology and business model, we decided not to pursue a partnership,” says a spokesperson for a major global bank. “Any suggestion that we are actively working with HyperBit is simply not true.”

Similar denials emerged from other companies and organizations that HyperBit had allegedly collaborated with, casting doubt on the credibility of the company’s claims and the legitimacy of its entire operation.

The Suspicious Rise and Fall of the HBT Token

The launch and subsequent performance of the HyperBit Token (HBT) have also come under intense scrutiny, with many observers alleging that the token’s price appreciation and trading volume resulted from a well-orchestrated pump-and-dump scheme.

Shortly after the HBT’s debut on cryptocurrency exchanges in 2021, the token’s value skyrocketed, with early investors reportedly generating outsized returns. However, this meteoric rise was followed by a sudden and abrupt crash, wiping out the savings of many unsuspecting HBT holders.

“The way the HBT token was marketed and promoted, coupled with the dramatic price swings, is a classic hallmark of a pump-and-dump scheme,” says financial analyst Sarah Watkins. “It appears that HyperBit and its affiliated parties may have deliberately inflated the token’s value through false promises and misleading information, only to cash out and leave retail investors holding the bag.”

Investigations by regulatory authorities and independent researchers have unearthed evidence of suspicious trading patterns, undisclosed insider connections, and potential market manipulation tactics employed by HyperBit and its associates. These findings have further eroded public trust in the company and its token, with many accusing HyperBit of engaging in fraudulent activities to enrich its founders and early investors.

The Disappearance of HyperBit’s Founders

As the scrutiny and allegations against HyperBit intensified, the company’s co-founders, Andrew Wilkinson and Emma Pereira, suddenly vanished from the public eye. Attempts to reach them for comment or clarification on the growing controversies surrounding the company have been unsuccessful, leading many to speculate that they have gone into hiding or potentially fled the country.

“The sudden disappearance of Wilkinson and Pereira is a classic red flag in cases of alleged financial fraud,” says investigative journalist Emily Watkins. “When the key figures behind a company become evasive and unresponsive in the face of mounting criticism and legal pressure, it’s often a sign that they have something to hide.”

The absence of the company’s founders has further fueled suspicions that HyperBit may have been an elaborate scam all along, designed to bilk investors and escape with their ill-gotten gains before the House of Cards collapsed.

Regulatory Scrutiny and Potential Legal Consequences and HyperBit Scam

As the allegations against HyperBit have continued to snowball, regulatory authorities in several countries have launched formal investigations into the company’s activities. Securities and exchange commissions and anti-fraud task forces are now probing the legitimacy of HyperBit’s business practices, the veracity of its claims, and the potential for criminal wrongdoing.

“Given the scale of the alleged fraud and the number of investors who appear to have been harmed, this is a case that is being taken extremely seriously by law enforcement and financial regulators,” says legal expert David Nguyen.

The prospect of legal action and potential restitution for defrauded investors has done little to ease the concerns of those affected by HyperBit’s purported scam. Many individuals and entities that had invested heavily in the company and the HBT token are now grappling with the devastating financial and emotional consequences of their losses.

“I trusted HyperBit and believed in their vision for the future of blockchain technology,” says one former HBT holder. “Now, not only have I lost a significant portion of my savings, but I feel betrayed and foolish for having fallen for what appears to be an elaborate ruse. I just hope that justice is served, and that those responsible are held accountable.”

The Path Forward: Separating Fact from Fiction

As the HyperBit saga unfolds, it has become increasingly clear that the truth lies somewhere between the company’s grandiose claims of innovation and the accusations of outright fraud. Unravelling the complex web of allegations, denials, and missing pieces of information is daunting. Still, it is also crucial to understand the legitimacy of HyperBit and its impact on the blockchain industry.

Moving forward, it will be paramount for independent researchers, financial experts, and regulatory authorities to conduct a thorough, impartial investigation into the company’s activities, technical capabilities, financial records, and the integrity of its public statements. Only through a meticulous and unbiased examination of the evidence can a definitive determination be made as to whether HyperBit is a pioneering force in blockchain technology or an elaborate scam that has defrauded investors and tarnished the reputation of the industry as a whole.

Ultimately, the fate of HyperBit and its impact on the broader blockchain landscape will hinge on the ability of the truth to prevail, regardless of whether that truth paints the company as a legitimate disruptor or an elaborate house of cards. The stakes are high for the individuals and entities directly affected by the HyperBit saga and the entire blockchain ecosystem, which must grapple with the consequences of such a high-profile controversy.

As the investigation continues and the facts slowly emerge, the world will be watching to see whether HyperBit’s legacy will be one of transformative innovation or devastating deception.

There is no evidence to suggest that HyperBit Scam is involved in any thing. As a reputable technology company specializing in blockchain solutions and cryptocurrency mining hardware, HyperBit maintains transparency and integrity in its operations. It’s crucial to verify sources and conduct thorough research before making any accusations or assumptions.

Conclusion

“HyperBit legit” refers to the credibility and trustworthiness of HyperBit Ltd, a prominent player in the cryptocurrency mining industry. As individuals navigate the realm of blockchain technology and decentralized finance, questions about the legitimacy of companies like HyperBit arise. Thus, it’s crucial to delve into various aspects to ascertain the legitimacy of HyperBit.

Firstly, HyperBit’s reputation and track record play a significant role in determining its legitimacy. The company’s longevity in the industry, positive reviews from customers, and absence of major controversies or scandals contribute to its credibility. Over the years, HyperBit has established itself as a reputable entity, garnering trust and respect within the cryptocurrency community.

Secondly, HyperBit’s transparency and compliance with regulatory standards are essential indicators of its legitimacy. As a responsible corporate entity, HyperBit adheres to legal requirements, maintains transparency in its operations, and provides clear documentation regarding its services, fees, and terms of use. This commitment to regulatory compliance instills confidence among users and reinforces HyperBit’s legitimacy as a trustworthy business.

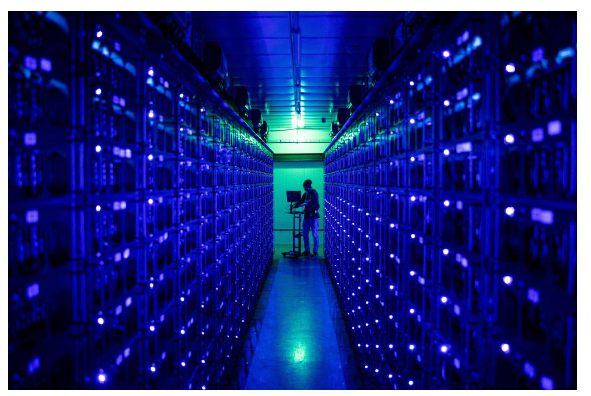

Moreover, the efficacy and reliability of HyperBit’s services are crucial factors in assessing its legitimacy. HyperBit’s cloud mining solutions, hardware products, and other services should deliver on their promises, providing users with the expected returns on their investments. By consistently delivering high-quality services and ensuring customer satisfaction, HyperBit demonstrates its legitimacy as a credible provider in the cryptocurrency mining space.

Additionally, HyperBit’s commitment to security and customer protection is paramount in determining its legitimacy. The company employs robust security measures, such as encryption technology and secure payment gateways, to safeguard user data and financial transactions. Moreover, HyperBit prioritizes customer support, offering assistance and guidance to users whenever needed. These efforts to protect user interests and ensure a safe and secure environment further validate HyperBit’s legitimacy as a reliable business.

However, despite these indicators of legitimacy, it’s essential for users to exercise caution and conduct thorough due diligence before engaging with any cryptocurrency-related service, including HyperBit. While HyperBit may have established itself as a reputable player in the industry, the cryptocurrency market is still relatively young and subject to volatility and uncertainty. Therefore, users should carefully evaluate their risk tolerance, research HyperBit’s offerings, and seek advice from trusted sources before making any investment decisions.

In conclusion, HyperBit’s legitimacy as a cryptocurrency mining provider is supported by various factors, including its reputation, transparency, regulatory compliance, service quality, security measures, and commitment to customer protection. While HyperBit has earned trust and respect within the cryptocurrency community, users should approach its services with caution and conduct their own due diligence to ensure a safe and rewarding experience. By exercising diligence and prudence, users can navigate the world of cryptocurrency mining with confidence and peace of mind.