Transparency Over Hype: Why Public Performance Dashboards Make Crypto Futures Signals Enterprise-Ready

Why transparency is more valuable than accuracy claims

In competitive markets, accuracy is often the headline metric. But for businesses and professionals evaluating crypto futures signals, accuracy on its own is not enough. What matters is transparency — the ability to see how signals performed in the past, how they are calculated, and whether results can be independently reviewed. Public dashboards, sample trades, and methodology notes separate serious providers from those selling hype.

What a performance dashboard delivers

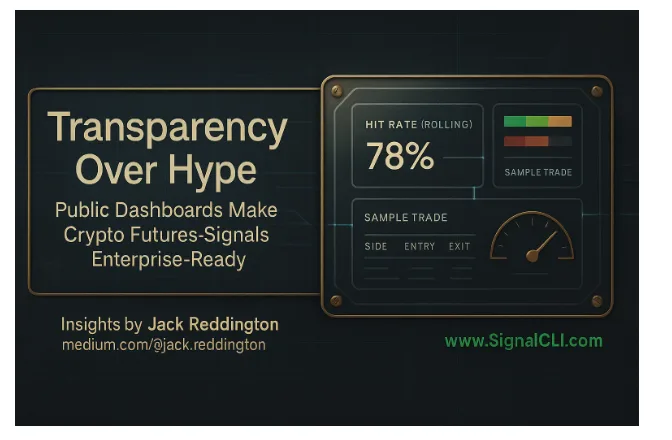

A credible crypto signals provider doesn’t just talk about win rates. It publishes a public performance dashboard showing:

- The number of signals issued in a given period.

- Win/loss ratios.

- Average holding time and fee impact.

- Rolling hit rates that anyone can verify.

This level of transparency allows businesses to treat signals as part of their infrastructure — just like they would with CRM data, financial reporting systems, or analytics dashboards.

Why sample trades matter

A strong provider includes a recent sample trade to illustrate how alerts translate into decisions. This example is drawn from the last 24 hours and shows instrument, side, entry/exit, and outcome — enough for readers to see the process without implying a full, timestamped dataset. A broader, fully timestamped sample library is planned for a future dashboard update.

The danger of hype without proof

Many platforms advertise AI-driven crypto signals with bold accuracy claims but no way to verify them. They may post social media screenshots of profitable trades while ignoring losses. Without transparency, accuracy claims become marketing tools, not performance metrics. Businesses that rely on these unverified claims risk misallocating capital, overtrading, and increasing fee drag without real edge.

Enterprise-ready means auditable

For signals to be enterprise-ready, they must be auditable. CFOs, compliance officers, and risk managers need to confirm that trades follow a documented process. Dashboards and logs make that possible. A provider that publishes detailed statistics, methodology notes, and historical results is far more valuable than one offering only bold promises.

Building trust with methodology notes

Methodology notes explain how signals are generated. They describe the mix of indicators, order flow analysis, and time-based filters like Zone grading and Gradients. While no provider will reveal every proprietary detail, credible notes show that there is structure behind the signals. For businesses, this documentation builds trust and justifies integrating signals into decision-making frameworks.

Lessons from professional users

Teams that rely on crypto futures trading signals for treasury or portfolio management report consistent benefits from transparency:

- Easier compliance reviews, since dashboards and logs can be shared with auditors.

- Faster onboarding for new team members, who can study historical performance to understand the system.

- Better capital allocation, since decisions are tied to data instead of gut feel.

The common theme: transparency reduces uncertainty. Professionals can plan with confidence when they know exactly how signals have performed under similar conditions.

Key takeaways

- Transparency is the real edge. Accuracy claims mean little without data to back them.

- Performance dashboards show win rates, holding times, and hit ratios across Zones.

- Sample trades demonstrate how signals behave in practice.

- Methodology notes build trust by showing the logic behind alerts.

- Enterprise-ready signals are those that are auditable, verifiable, and consistent.

Why transparency matters now

As adoption of crypto futures signals grows, businesses will prioritize providers that treat transparency as a feature, not an afterthought. Public dashboards, sample trades, and clear methodology will define which platforms earn institutional trust. Traders and businesses that choose transparent systems gain more than signals — they gain clarity, auditability, and discipline. That combination makes signals enterprise-ready.

About SignalCLI

SignalCLI is a crypto futures signals provider focused on clarity, precision, and informed decision-making. Using a combination of established technical indicators, Smart Money Concepts, and advanced AI analysis, SignalCLI delivers structured, data-driven insights to help traders identify high-probability setups in fast-moving markets. The service is designed for those who value disciplined execution, risk awareness, and timing over speculation. For deeper insights and practical examples, visit www.signalcli.com and explore Jack Reddington’s Medium for trading strategies, market breakdowns, and educational articles.