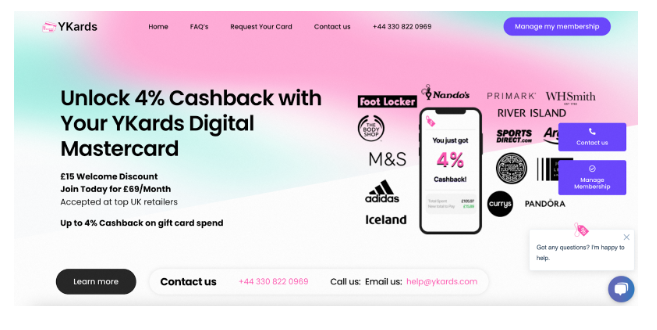

YKards Review – Unlock 4% Cashback

Finding the right card that aligns with your spending habits and financial goals can be daunting. With numerous options available, each offering unique reward structures and benefits, it’s essential to delve into the details of each card to make an informed decision. This review focuses on YKards, a digital Mastercard that promises to revolutionize your shopping experience with its 4% cashback offer. Let’s explore how YKards works and what makes it stand out in the crowded cashback credit card market.

Try YKards today and start earning 4% cashback on your purchases: https://ykards.com/

How YKards Works

YKards operates on a simple yet effective principle: sign up, use your YKards Mastercard, and earn cashback on purchases. Here’s a step-by-step breakdown:

- Sign-up to YKards: Joining YKards is straightforward. You can start with a 3-day free trial to experience the benefits firsthand.

- Use Your YKards Mastercard: Once you’re a member, you can use your YKards Mastercard for purchases at over 130 top brands, both online and in-store.

- Earn Cashback: With YKards, you earn 4% cashback on every purchase, making it a lucrative addition to your wallet.

Benefits of YKards

- £15 Welcome Discount: New members receive a £15 welcome discount, which can be used immediately at your favorite retailers.

- 4% Cashback: The 4% cashback rate is one of the highest in the market, offering substantial savings on all purchases.

- Flexibility: With access to over 130 top brands, YKards allows you to shop where you want and still earn cashback.

Understanding Cashback Credit Cards

Cashback credit cards offer a percentage of your qualifying spending back in the form of cash rewards. These cards can have flat rates, tiered rates, or even allow you to choose your bonus categories. For example, some cards offer 3% cash back on groceries and gas, while others provide a flat 2% cash back on all purchases.

Comparing Cashback Credit Cards

When choosing a cashback credit card, it’s important to consider factors such as cashback rates, annual fees, and sign-up bonuses. Cards like the Wells Fargo Active Cash Card and the Citi Double Cash Card offer competitive rates and no annual fees. Meanwhile, cards like the Prime Visa offer 5% cash back on Amazon purchases, making them ideal for frequent Amazon shoppers.

Cashback Industry Trends

The cashback industry is evolving, with a growing emphasis on personalization and innovative reward structures. Mobile transactions account for 65% of all cashback website purchases, and the average cashback rate globally is around 6%. The travel sector sees an average cashback rate of 8%, the highest of all sectors.

Conclusion

YKards stands out in the cashback credit card market with its 4% cashback offer and £15 welcome discount. Its simplicity and flexibility make it an attractive option for those looking to maximize their savings. Whether you’re a seasoned cardholder or just entering the world of cashback credit cards, YKards is worth considering.

Latest 2024 News

The cashback industry continues to grow, with new cards and offers emerging regularly. Recent trends highlight the importance of personalization and digital integration in cashback programs. For example, Vietnam’s loyalty programs market is expected to reach $1.54 billion by 2028, driven by technological advancements and changing consumer preferences. As the industry evolves, cards like YKards are at the forefront, offering innovative reward structures that cater to diverse consumer needs.